In terms of the transfer market, much of the reporting in the international media focuses almost exclusively on the evolution of the Premier League among the other major European leagues and now Saudi Arabia as an aggressive breakthrough in investment and attractiveness. This puts leagues that cannot compete financially in a selling position, trying to maintain their position in the face of the flood of money. But something quite interesting to analyse is happening away from the top European level.

The evolution of the Brasileirao since 2018 deserves our attention. The arrival of foreign capital acquiring clubs, the increases in TV revenue, the position of strength with more presence than any other country in the Copa Libertadores and the turnover revenue of the 20 Serie A clubs have positioned and made Brazil the great dominator of South American football. With the production of talent being, until recent years, the main means of financing clubs, in recent years they have managed to make their league much more attractive and transform the flows and amounts of sales. All this has earned them the title of the best league in the world in the last two years according to the IFFHS, based, among other criteria, on the number of teams playing in international competitions.

*No transfers, free transfers or transfers between Brasileirao clubs are counted; only purchases from other leagues are counted.

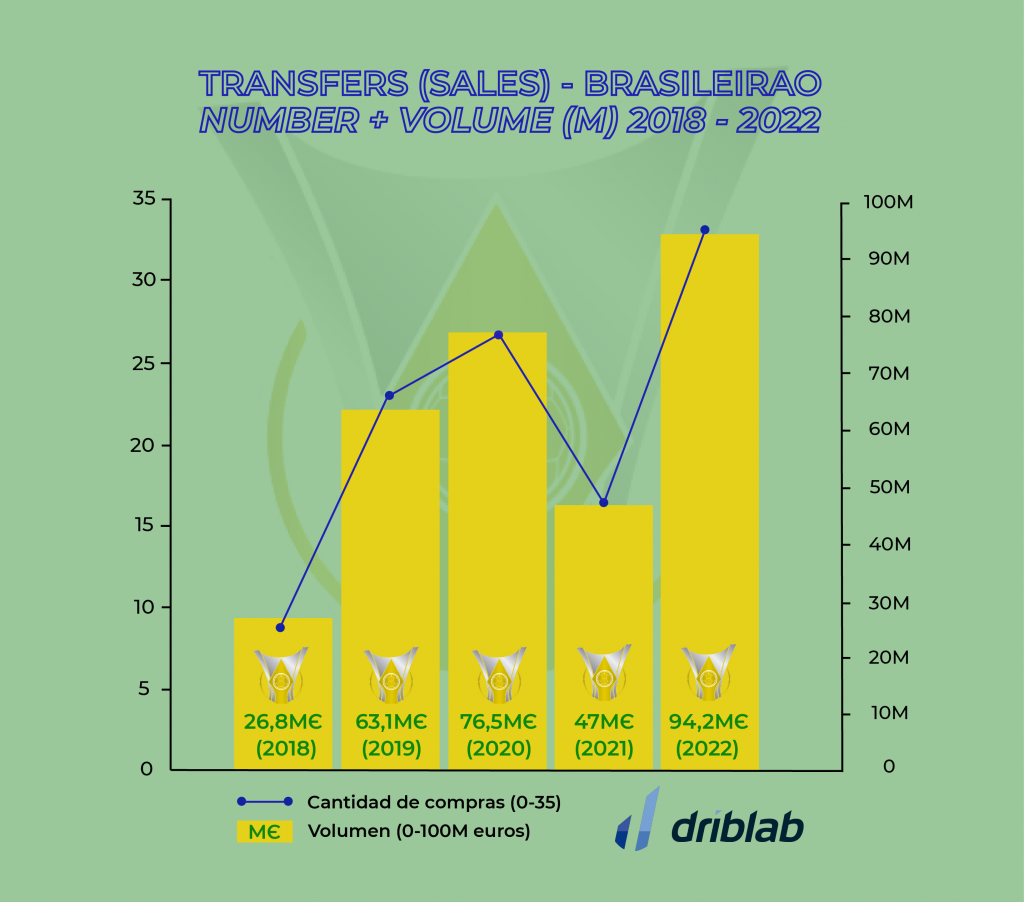

Going deeper into our database, as we can see in the graph above, we wanted to know how the Brasileirao was evolving in its investment capacity and in the dynamics of buying and selling players. We saw that in purchases alone (not taking into account transfers, free transfers or transfers between Brasileirao clubs), the Brazilian championship has almost quadrupled what it has invested in purchases since 2018.

In just five years it has gone from spending €26.8 million to investing €94.2 million. Although it is still a country that produces talent, perhaps the most important in the world in terms of quantity and quality, its ability to retain and attract great players is increasing. Its league is becoming increasingly attractive and competitive. And this is reflected in the market. From these purchases, the CONMEBOL leagues have come to represent an important weight. In 2018, 30% of the purchases came from South America’s top divisions, while in 2022, they accounted for 51% of the total purchases in the Brasileirao.

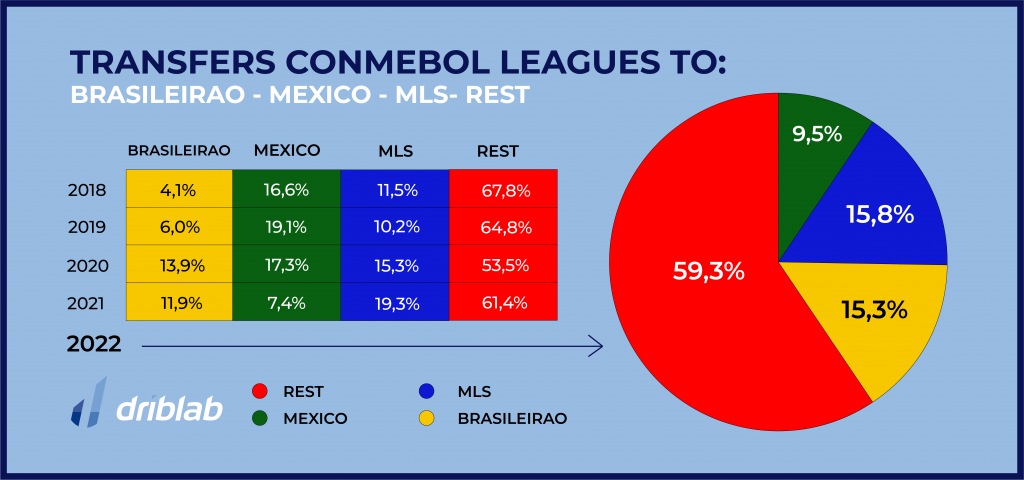

In recent years, as seen in the graph above, the Brasileirao has become one of the main buyers of players from the region. In 2018, Brasileirao was the destination of 4% of CONMEBOL league sales; in 2022 is the 15.3%. In other words, of the total sales of all CONMEBOL leagues, in the last year (2022) 15.3% ended up in Brazil. In the chart above we can see how the CONMEBOL market has been evolving in relation to Mexico, MLS and the rest of the world and its correlation with Brazil. Liga MX has gone from being the destination of 16.6% of sales to only 7%, with Brazil being the country that absorbs the most talent from other South American leagues.

In 2018, the Brasileirao was the destination of 4% of CONMEBOL league sales; in 2022 is the 15.3%.

In short, the data shows that the Brasileirao is exerting great power over the leagues around it and is investing more and more in buying foreign talent, balancing the balance between exporting and importing countries. In 2022, up to 18 clubs invoiced more money than 80% of the clubs in the Spanish league, a hugely attractive economic scenario on the American continent.

Founded in 2017 as a consultancy, Driblab has driven innovation through data in all aspects of professional football. Thanks to a transversal model, its database collects and models statistics in all directions. From converting matches and videos into bespoke data for training academies to developing cutting-edge technology, helping clubs, federations and representative agencies in talent scouting and transfer markets. Driblab’s smart data is used by clubs all over the world, with success stories such as Dinamo Zagreb, Real Betis and Girondins Bordeaux among others. Here you can find out more about how we work and what we offer.